4 Miles per S$1 on Overseas Spend and Visa payWave - UOB Visa Signature Card

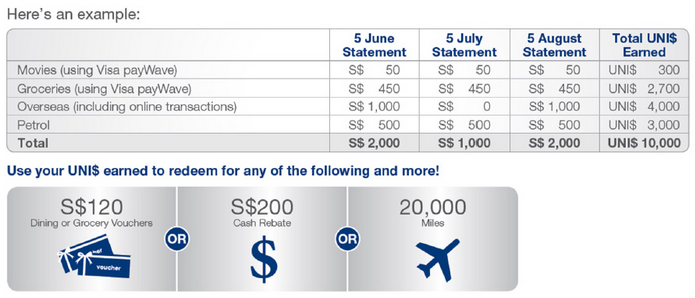

If you tend to spend between S$1,000 to S$2,000 each month in foreign currency (do note this includes foreign currencies at merchants with payment gateway in Singapore), you can easily earn up to 4 miles per S$1 (or 5% rebate) each month. The UOB Visa Signature is not a card that is often being mentioned but yet it is one of the rare few cards in the market that gives you 4 miles per S$1 (even online transactions!) which is issued in UOB UNI$ (similar to other UOB credit cards) that you can redeem for miles or cash back (effectively 5%). Find out how you can fully maximise the benefits below:

Click HERE to find out more about the UOB Visa Signature Card!

1. Spend in Foreign Currency

If you shop on a bunch of online websites, travel from outside of Singapore or even swipe your credit card overseas, you can potentially earn the maximum rebate and miles on this card. Do remember that in order to even qualify for 4 miles per dollar or 5% cash back, a minimum spend of S$1,000 in FOREIGN currency is required.

2. Tap and Go (Visa payWave) and Petrol

Holders of the UOB Visa Signature Card will also earn 4 miles per S$1 (or 5% cash back) on Visa payWave and Petrol transactions when a LOCAL spend of S$1,000 is met (per statement period). Do note that all SMART$ merchants are excluded from this - even if it is a petrol of Visa payWave transaction.

3. Spend Below S$2,000 in Foreign Currency a Month

Well, technically you can but any foreign currency spend above S$2,000 will only give you an effective mile accrual rate of 0.4 miles per S$1 (or 0.5% cash back). So for your own benefit, stop at S$2,000.

Photo Credit: UOB

FINAL THOUGHTS

The UOB Visa Signature Card is perfect for people who are confident of spending S$1,000 to S$2,000 in foreign currency per statement period. Keeping in the mind the list of exclusions for online transactions, I gather that it is a lot easier to use it if you physically swipe it overseas. If you travel for business and book the flexible rate - you will usually only settle the bill at the end of the stay (just remember to pay in the local non-SGD currency). Do consider the DBS Altitude Visa Signature Card for 3 miles per S$1 for overseas spend if you are spending S$2,000 to S$3,000 a month in foreign currency instead.

The new Go with Amex campaign has arrived in Singapore, offering up to S$790 in statement credits for hotel spending.